June 29, 2022

Free Tax Help Available for Income-Eligible County Residents Through the Volunteer Income Tax Assistance Program

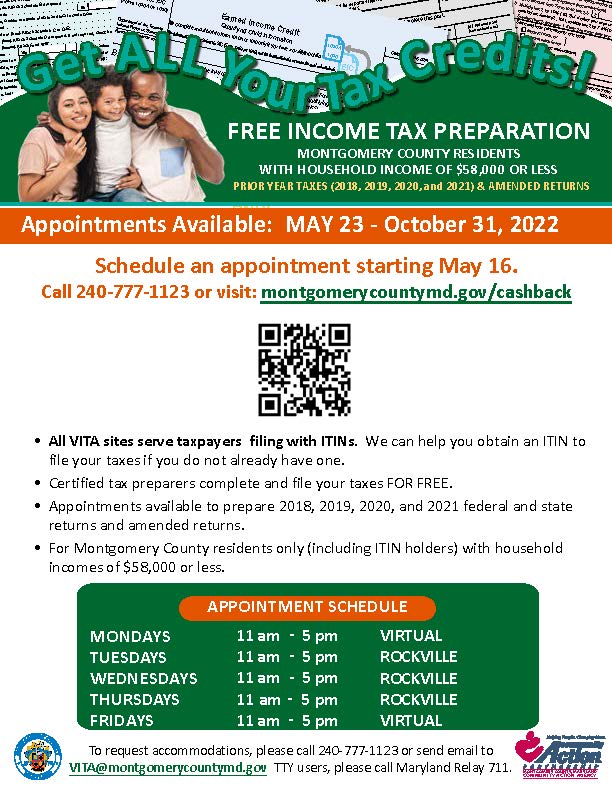

The Community Action Agency's Volunteer Income Tax Assistance (VITA) program, Montgomery County’s only year-round VITA program, is offering free tax help for the current year (2021), prior years (2018-20) and for amended returns. Virtual and in-person appointments are available for County residents with household incomes of $58,000 or less.

Now through the end of October, in-person tax appointments are available from 11 a.m.-5 p.m. on Tuesdays, Wednesdays and Thursdays at the Community Action Agency office, which is located at 1401 Rockville Pike, Suite 320, in Rockville. Virtual appointments are available from 11 a.m.-5 p.m. on Mondays and Fridays. Assistance with Individual Taxpayer Identification Number (ITIN) applications is available on Thursdays.

As part of VITA’s free tax help, the program links residents with valuable tax credits that can provide critical support to households. This year’s historic expansion of the Federal and State Earned Income Tax Credit (EITC), the Child Tax Credit and the County’s Working Families Income Supplement (WFIS) added thousands of dollars in tax refunds that may be available for individuals and families. This included ITIN taxpayers who were eligible for the State EITC and the County WFIS for the first time.

It is not too late for residents to claim these credits. VITA helps ensure that taxpayers receive all credits for which they are eligible.

Information about post-season appointments is available on the CASHBACK website in English, Spanish, Amharic, Chinese, French, Korean and Vietnamese. Eligible residents may schedule an appointment by calling 240-777-1123 or by visiting the CASHBACK scheduling page.

Visit the Community Action Agency’s website for more information.